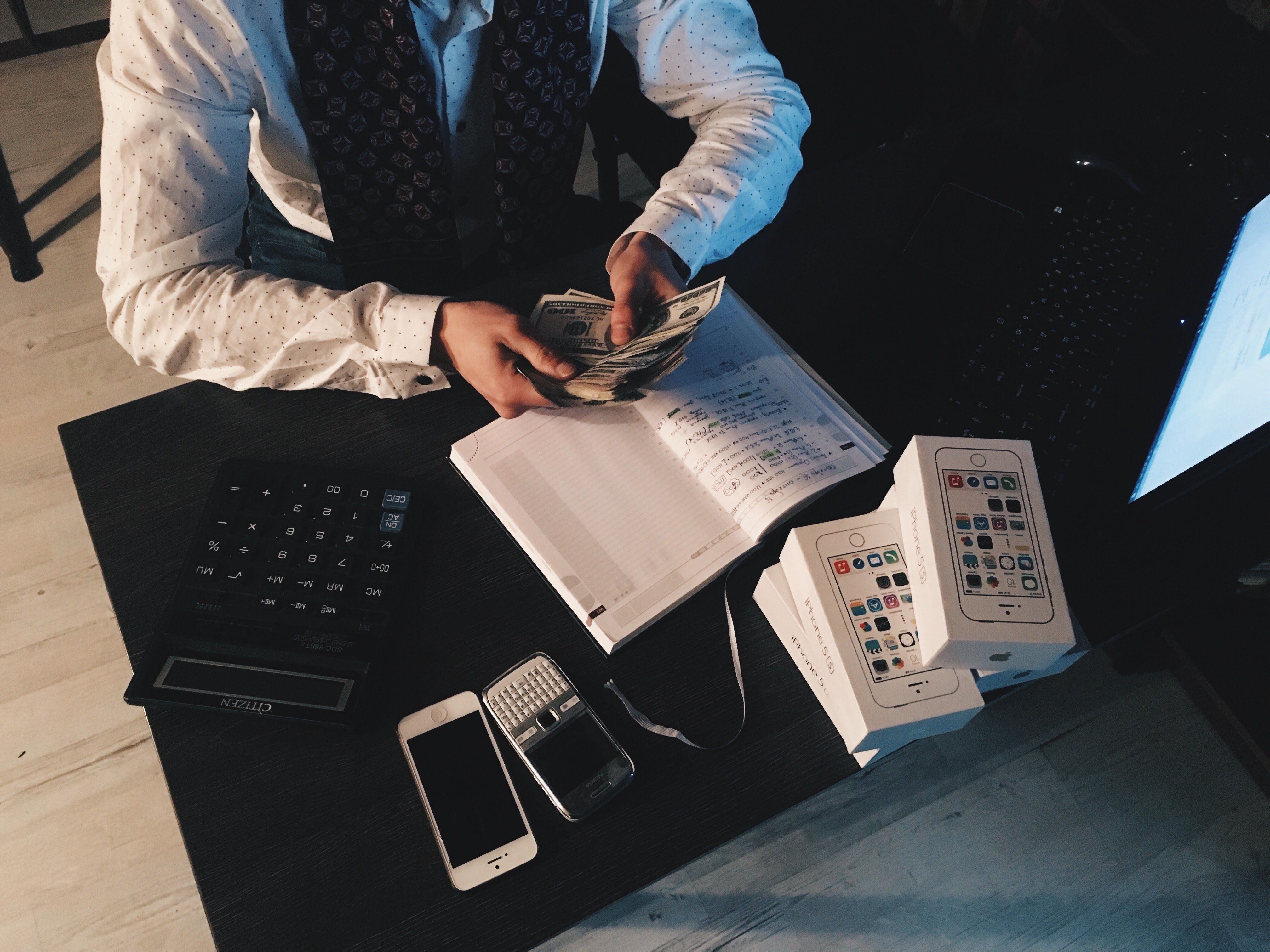

![]() There's no time like right now to start learning how to invest money. In fact, investing money is one of the core topics here at The Fortunate Investor for a simple reason - stock market investing can be an excellent way to grow your wealth. But, truth be told, it's also a topic that a lot of people are nervous about. What is the best way to invest money? What are the best investments to make? To answer your investment questions, we’ve created a range of articles to share our expertise on ways to invest money to ensure that you have the information you need to make great financial decisions for you and your family. Whether you're just opening your first investment account, or are a seasoned investor looking for key insights on market trends that could impact your portfolio, or if you want to know how to invest money to make money, we’ve got you covered.

There's no time like right now to start learning how to invest money. In fact, investing money is one of the core topics here at The Fortunate Investor for a simple reason - stock market investing can be an excellent way to grow your wealth. But, truth be told, it's also a topic that a lot of people are nervous about. What is the best way to invest money? What are the best investments to make? To answer your investment questions, we’ve created a range of articles to share our expertise on ways to invest money to ensure that you have the information you need to make great financial decisions for you and your family. Whether you're just opening your first investment account, or are a seasoned investor looking for key insights on market trends that could impact your portfolio, or if you want to know how to invest money to make money, we’ve got you covered.

Getting Started: How to Invest Your Money

If you're a first-time investor, you've probably got a lot of questions about the best way to invest money. We're here to provide the answers you need to make the most out of stock market investing - from understanding traditional investments to micro-investing to the importance of diversification. Investing money for beginners isn't rocket science, but it does require learning some basic investing concepts, so you can create an investing strategy that works for the long term. You need to learn where to invest money to get good returns, as well as developing realistic expectations about how high those returns will be. The more you learn, the better decisions you'll be able to make. There are plenty of ways to invest your money - we make sure you have the information you need to target the best ways for your unique needs.

Topics:

Where to Invest Money

Watching the phenomenal growth of some start-ups like Facebook, Instagram or Crew, it's tempting to want to get a piece of the action - but are start-ups really a good investment? And what about staple goods? How much does consumer confidence impact the market value of these types of investments? Here are a few articles that share important details you'll need to know before you invest your money in these types of opportunities.

If you're a first-time investor, you've probably got a lot of questions about the best way to invest money. We're here to provide the answers you need to make the most out of stock market investing - from understanding traditional investments to micro-investing to the importance of diversification. Investing money for beginners isn't rocket science, but it does require learning some basic investing concepts, so you can create an investing strategy that works for the long term. You need to learn where to invest money to get good returns, as well as developing realistic expectations about how high those returns will be. You’ll need to understand what terms such as ‘mining cryptocurrencies’ and ‘portfolios’ mean so you can get all the data you need to keep your money safe. The more you learn, the better decisions you'll be able to make. There are plenty of ways to invest your money - we make sure you have the information you need to target the best ways for your unique needs.

Topics:

Micro-Investing

Becoming a micro investor is an excellent option if you'd like to start investing, but don't have a lot of funds set aside for the effort. In fact, micro-investing is one of the best ways to invest money in your 20s because you don't need to have a large nest egg set aside to get started. In fact, you can invest $20 with most micro-investment apps to open an account that you can use to learn the basics of investing. It might not seem like much, but this isn't about becoming a millionaire overnight - it's about starting to develop an understanding of how the stock market works, how to invest money wisely and which investments are the right fit for you. Today there are multiple apps and websites that make it much easier to begin investing with limited capital. We review the basics of micro-investing and reveal the best apps to get started with.

Topics:

All Articles

The Difference Between Residential & Commercial Investments

- Turning Untouched Land into an Investment Opportunity

- Simple Ways To Stay Informed About Your Investments

- Exploring Alternative Investments for 2025

- Building Wealth: How to Get Started

- Navigating the Property Market When Supply is Tight and Prices Are High

- Thinking of Becoming A Landlord? Take These Tips Onboard for Success

- Understanding Different Types of Blockchains

- 5 Crucial Things Every Crypto Investor Needs To Know

- 7 Tips for Wealth Management

- Five Tips for Investing in Property

- Overcoming The 3 Biggest Barriers To Real Estate Investing For Beginners

- Getting Your Ducks In A Row: How To Make Sure You’re Making The Right Investment Decisions

- 5 Things to Look for When Buying Stocks

- 12 Best Practices for Buying Tax Delinquent Properties

- Tips On Understanding The Considerations That Need To Be Made When Investing

- 3 Effective Ways To Get Better At Investing

- Investing Your Money Back Into Your Home: The Benefits Of Upgrades

- Democratizing Investment: Exploring Opportunities for Non-Accredited Investors

- The 5 Best Ways To Ensure Your Investments Stay In The Family

- Timepiece to Treasure: Maximizing Your Watch Investment for Profit

- Forget Property Prices, Consider These Sure Signs That A New Home Could Cut Your Lifestyle Costs In Half

- Why 2024 is the Year to Finally Start Investing

- Five Areas To Invest Your Money

- Are You In A Position To Invest?

- Unveiling The Crypto Revolution And Its Inevitable Rise

- How To Invest Safely As A Beginner In 2024

- An Investor’s Guide To Navigating A Complex Real Estate Market

- Emerging Market Currencies: Where to Start in Forex

- Success Strategies for Commercial Real Estate Developers

- A Guide to Real Estate Investing for a Beginner

- Getting Started: Beginner-Friendly Tips for Real Estate Investment

- Community-Centric Real Estate Projects: A New Era of Investment

- 5 Tips for Successfully Reselling Your Timeshare

- 7 Money-Savvy Secrets Crypto Entrepreneurs Swear By

- 7 Real Estate Investing Tips To Take Advantage Of

- Environmental Impact Assessments: A Must-Know for Land Developers

- Rental Property ROI: 11 Tips for Maximizing Returns on Your Real Estate Investments

- Use Your Home to Your Benefit When You Want to Make Money

- How to ensure success when entering the property market

- Marketing is Worth the Investment – Here’s Why!

- Investing in Business Infrastructure: Beyond the Physical Assets

- 8 Expert Tips To Reduce Real Estate Investment Risks

- How to Invest in Bitcoin: A Beginner’s Guide

- Unlocking Trust Mysteries: An Adventure in Wealth Management

- How To Earn Fixed Returns In A Volatile Market

- A Beginner’s Introduction to Using Coinbase

- Some Of The Best Investment Choices For Those New To The Game

- Are Apartments a Wise Investment?

- Ready to Invest? Here Are Seven Worthwhile Ideas

- Understanding The Risks Associated With Investments: The Ins And Outs To Safeguard Your Funds

- How To Become A Successful Cryptocurrency Investor

- How To Invest In Startups

- The Pros and Cons of 770 Account

- What Makes a Good Investment? 3 Rules for Starting Out

- Guide for Real Estate Investors: 4 Types of Multifamily Financing and Terms

- Before You Invest, It Is Essential To Understand 8 Key Elements

- Consumer Startups: Great Investments

- Learning from the Fisherman but Not How You Might Think

- A Beginner’s Guide to Making Smart Investments

- Micro Investing Apps: The Best Platform For 2024

- Getting Started in the Stock Market

- Why You Need An Exit Strategy As A Property Investor

- 7 Tips to Make Money from Real Estate Investing

- Money In Your Digital Wallet: Cryptocurrency For The Novice Investor

- The Why and How to Investing in Bitcoin

- 5 Reasons Your Rental Venture Fails (and How to Fix Them)

- How to Choose an Investment Property

- How To Be Successful In A Property Investment Partnership

- How to Invest In Startup Companies

- Signs You’re Ready to Start Investing

- What is a Reverse 1031 Exchange?

- Investment Mistakes People Often Make

- Essential Things to Research Before Buying a Home

- Different Types of Real Estate: Which One Should You Invest In?

- Buying A Project Property: What You Need To Do Next

- The Benefits Of Investing In Commercial Property

- Essential Considerations For Financial Planning

- 7 Precious Metal Investor Mistakes and How to Avoid Them

- People Who Can Help Your Real Estate Investments Thrive

- 5 Things You Need to Know Before Investing in Real Estate

- The Complete Guide to Creating a Real Estate Investment Plan

- 5 Strong Reasons Why Investment Planning Services Are Popular

- 7 Steps To Make Your Investing Journey Successful

- What Is a 1031 Real Estate Exchange?

- Trading Forex vs Stocks: What Are the Differences?

- Collecting Coins: Where Should You Start?

- Why You Should Get a Title Insurance When Investing in Real Estate

- Where Should You Invest When Inflation Is Rampant?

- Planning on Investing in a Holiday Resort: Here’s 6 Tips to Help Your Corporate Transition

- Different Types of Gold to Invest In

- What Precious Metals To Invest In

- Top 4 Reasons to Invest in Platinum Bars

- What to Know About Gold IRA Companies

- Do ETFs expire?

- 4 Tips for Building the Best Investment Portfolio

- Top 5 Real Estate Social Media Mistakes and How to Avoid Them

- Strong Signs That A Piece Of Land Is Worth Investing In

- 5 Tips To Help Perfect Your Investing Ventures

- Is Commercial Real Estate Worth Investing In?

- 3 Small Home Investments That’ll Improve Its Value

- 3 Investments That’ll Help With Retirement

- Important Areas to Focus On When Investing in Real Estate

- Things To Consider When Taking Your Investments Global

- How To Make The Most Of Your Money With Wise Investments

- Where To Put Your Money: Tips To Help You Plan Your Next Investment

- 7 Current Economic Policies Every Investor Should Know About

- Key Reasons Real Estate Is A Great Investment

- The Bitcoin vs Gold Debate: Which is a Better Investment?

- How To Avoid Buyers’ Remorse When Purchasing Property

- Top Investment Trends to Look Out for in 2022

- Top 3 Real Estate Investing Tips You Need to Know

- 7 Tips for Finding the Best Long Term Investment

- The Ins And Outs Of Commodity Investing

- What You Need When Investing in Property: Real Estate Investment Tips

- 3 Tips for Finding the Best Wallet for Crypto

- What Buyers Look For In A Prospective Property

- What You Should Known Before Starting Your Investment Process

- 5 Mistakes Beginner Investors Often Make

- 4 Reasons Why You Should Invest in Crypto

- Intro to Trading Systems for A Beginner Investor

- 4 Useful Tips for Overseas Landlords

- How Much Do You Need to Invest in Real Estate? A Guide for Beginners

- Growing Your Investment Portfolio With Property: Top 4 Things To Consider

- Here’s Why Downtown Miami Is a Great Place to Live — And Invest

- The Pros and Cons of Being a Property Manager

- Avoid These 5 Online Investment Ideas Like The Plague

- Investment Mistakes Everyone Needs To Avoid

- How to Maximize Your Real Estate Investments

- What kinds of assets are available for trading?

- When to Walk Away from a Rental Property Investment Opportunity

- 6 Investment Options to Help Build Your Retirement Fund

- Why Should You Invest In The Healthcare Industry?

- The Habits Of Successful Investors

- 5 Questions To Help You Find The Right Online Moneymaker

- Five Reasons Gold Bars Are A Wise Investment

- Top 3 Benefits of Hiring a Portfolio Manager

- 4 Important Maintenance To Do For Your Commercial Property

- Debunking the Most Common Stock Trading Myths That Exist Today

- What Are the Financial Benefits of Investing in Real Estate?

- 4 Common Gold Trading Mistakes and How to Avoid Them

- Steps To Reduce Investment Risks

- 3 Tips For Planning for Future Investments

- Is It Time To Invest In Your Home?

- 4 Tips To Diversify Your Investment Portfolio

- How to Buy Bullion Coins Online

- Tips To Know When Investing in Cryptocurrency

- Non-Visible Hazards That May Affect The Value Of Your Property

- What Are the Financial Benefits of Portfolio Diversification?

- 4 Mistakes That Can Harm Your Real Estate Profits

- The Ultimate Guide to Trading Illiquid Assets

- Can You Invest With A Small Amount Of Money?

- What Are the Investment Strategies of Warren Buffett?

- 11 Incredible Benefits of Investing in Cryptocurrency

- Tips For Investing In Property

- Identifying Your Next Big Investment Opportunity

- 7 Real Estate Investing Tips for New Investors

- What Exactly Is Compliance And Why Does It Matter In The Stock Market?

- Before You Spend: What Is the Future Value of Investment?

- Mutual Funds vs Stocks: What’s the Difference?

- 9 Important Reasons to Invest Your Money Right Now

- The Principles of Investing

- When Is It Time To Leave Your Investments?

- 4 Ways to Make Money from the Property Industry

- What You Need to Know About Options Trading in the Netherlands

- Top Tips for Staying Safe When Banking and Investing

- Metalwork and Jewelry: Titanium is The Future

- Rental Property Tips For First Time Investors

- What Does Ethical Investment Look Like?

- Can You Remove The Risk Of Crypto Investments?

- 7 Benefits of Being an International Investor of Mutual Funds

- Things to Consider Before Buying an Older Home to Rent Out for Investment

- 5 Clean Stock Investment Tips for Generous Returns

- Quick $1,000 Investments You Can Make, Starting Today

- How Best To Invest In Property

- What Is the Best Stablecoin?

- Property Investment Vs Buy to Let: What You Need To Know

- Real Estate Investments: Knowing When To Cut Your Losses

- Property Investment Niches Compared

- 3 Investment Opportunities That Guarantee Profit

- Things to Consider Investing in for Those Who Aren’t Looking to Spend a Lot

- Cha-Ching! The Beginner’s Guide on How to Invest in Gold

- You Must Invest In Your Tech!

- Key Reasons Why You Should Invest in Real Estate

- Essential Tips to Buying Silver That You Absolutely Must Know

- A Beginner’s Guide to Entering the Stock Market

- The Poor Work For Money, The Rich Work For Assets

- Starting To Invest? Read The Following Books

- Investing in Notes 101: What Is It and How Does It Work?

- How to Successfully Manage a Commercial Property

- Tips on How to Become a Successful Real Estate Investor You Should Know

- These Are the Top 4 Ways to Get Passive Income

- What to Know Before Investing in Classic Cars

- Why Commercial Property Investments Work So Well

- What Is the Australian Securities Exchange?

- Not 2nd Place: Why Silver Coin Collecting Is a Golden Hobby

- An Investors Guide on the Different Types of Silver That Exist Today

- Is Investing In Malaysian Commercial Real Estate Expensive Or Not?

- A Guide To Investing In Gemstones

- What Should You Trade as a New Investor?

- A Beginners Guide To Making Investments In Foreign Markets

- How To Spot A Company With Long-Term Potential

- Getting Real About Investing In Real Estate

- Securities: 5 Secrets of Successful Investing You Need to Know

- Plastic Or Metal For Your Pipework System? The Battle

- Property Investment Portfolio For All Budgets

- 4 Factors to Consider Before Buying an Investment Property

- 8 Investment Tips Every Beginner Entrepreneur Needs to Know

- Recent Investment Lessons We Should All Take To Heart

- 4 Contacts You Will Need To Be Successful In Real Estate Investing

- The 3 Reasons Cryptocurrency Is On The Rise Yet Again

- How To Take The Luck Out Of Investing

- 4 Tips for Choosing Which Company to Invest in

- Four Apps To Use When Investing

- Finding A Buyer Quickly When Flipping A House

- Beginning Bitcoin: 10 Pro Tips for Using Cryptocurrency

- Beyond Bitcoin: Types of Cryptocurrency You Should Know About

- Property Gurus Keep Their Techniques Secret, But Anyone Can Learn Them

- From Browsing To Buying- How To Find The Perfect Real Estate Investment

- How To Maximize Your Money In Real Estate Investing

- Investments to Make in 2021

- Top four mistakes committed by the rookie traders

- Crucial Compliancy: 5 Investments To Stick to the Regulations

- Financing Investment Projects: A Beginner’s Guide

- 7 Great Ways To Invest Your Money

- The Biggest Real Estate Opportunities of 2021

- Some of the Best Ways to Invest in Real Estate Right Now

- Stock Market Basics: Tips for Picking the Right Stocks for Your Portfolio

- Investing In Cars: Can You Do It & Does It Make Sense?

- The Fastest Ways To Learn About Trading and Start Making a Profit

- Investing: Learning About Market Trends

- The Safest Places To Invest For A Profit (Or A Return)

- 3 Reliable Ways To Invest Your Money

- 4 Advantages of Investing in Israel

- 4 Ways to Protect Your Investment

- Investing Basics for Beginners

- 5 Compelling Reasons to Invest in Commercial Real Estate

- Top 5 Low-Risk Financial Investments That Will Boost Your Finances

- Thinking About Flipping Houses? Here’s What You Should Know

- Here Are Investments You Should Consider

- Looking to Get Approved for a Commercial Real Estate Loan? Follow These 3 Tips

- The Best Reasons To Invest In Marijuana Stocks

- Why You Should Invest in Medical Stock

- Don’t Invest In Commercial Property Unless You Know These 3 Things

- Tips for Effective Crypto Trading

- Investment Ideas that are Suited to Those in Their 20’s

- Enhancing trading performance with three easy techniques

- Not Sure What To Do With Your Money This Year?

- 6 Things to Invest Your Money In

- 6 Ways to Invest with Only $1000 in the Post-Pandemic Economy

- What Investments Really Return In Sales?

- Making Good On Your Real Estate Investments

- Why Is Land Such A Great Investment?

- What Does It Mean To Invest in Luxury Real Estate?

- Investing 101: Smart Ways to Beat the Crowd When Investing in Real Estate

- Considering Investing in 2021? Here are Some Things to Consider

- Where To Invest Your Money in 2021

- New Types Of Property Investment You Need In Your Portfolio

- 5 Reasons To Invest In Used Machinery

- 5 Tips for First-Time Investors

- The Basics of Investment Tracking

- Forex Industry and the Interest Rate of a Currency

- Buying A Business Website: What You Need To Know

- 3 Sure Fire Ways To Keep Your Property Investment Secure

- The Safest Investment for 2021: 5 Low-Risk Places to Put Your Money

- 5 Best Investment Apps in 2020

- Real Estate Investment Myths You Probably Believe

- What to Consider Before Investing

- Are You Too Old To Begin Investing?

- When Assets Go On Sale, Buy, Buy, Buy

- 5 Expert Predictions About the Future of Cryptocurrency

- Why Real Estate Is An Absolute Steal Right Now

- 5 Investment tips for investing in stocks

- Reasons Why You Should Invest in Real Estate

- Essential Things You Must Know When Investing In A Family Home

- How Safe Are Your Investments?

- 6 Reasons To Get Into Property

- Valuable Metals: What They’re Worth and Where to Find Them

- Is COVID Good for Cryptocurrency?

- Top Tips For Buying A Renovation Property

- Effective Night Vision In The Defense Sector

- Twitter could be on the path to recovery

- Investments for Beginners: 5 Easy Tips to Try

- The Long Dip: Investing In Commercial Property

- Are You New To Investing? We’ve Got Some Advice For You

- Interesting Stock Market Facts for Beginners

- Why You Should Diversify Your Portfolio

- 4 Property Flipping Tips For Beginners

- 5 Diverse Investments to Add to Your Portfolio

- Why Invest in Real Estate: 5 Top Benefits of Investing in Real Estate

- Landlord Tips: 3 Excellent Recommendations for First Time Landlords

- Expert Advice for Making your Very First Investment

- The 5 Dos and Don’ts of Selling Land by Owner

- How to Day Trade: 10 Day Trading Tips for Beginners

- Where Should You Invest Long-Term?

- Five Forex Favorites for Top Traders

- How Globalization has Affected Investments

- Is It a Smart Idea to Invest in Stocks While You’re Still in Debt?

- Real Estate Tycoon: 5 Must-Know Tips for Investing In Commercial Real Estate

- How To Get Serious About Being An Investor

- Break the Bank: 6 Better Investments Than a Savings Account

- Investments Done Right: Answering 9 Frequently Asked Questions About Qualified Opportunity Zones

- Hidden Things To Look For When Investing In Real Estate

- Adding Variety To Your Investment Portfolio

- Electromagnetic Flow Meters Market Increases And Here’s Why

- Alternative Investments: The Mining Sector

- The 3 Best Commodities To Invest In Right Now

- Innovative Investments

- The Best Investment Advice for Novice Investors

- How to Get Better at Real Estate Investing

- Increase Your Financial Potential & Invest Your Savings

- Boring Stocks to Purchase Now

- Stay the course in Tumultuous Times to Build Long-Term Wealth

- Could Investing in Property Be a Money Maker for You?

- Change Is Coming For Builders, But Not In The Way They Imagine

- 5 Tips For Investing In Property

- I’ll Huff, I’ll Puff, And I’ll Blow Your Property Development Down

- Investing in Your Future: 4 Benefits of a Roth IRA

- Why 2020 Could Be The Year To Invest

- The Benefits Of Investing In A Lawyer

- Investing 101: Investing in the Stock Market in 5 Steps

- The Market Is Down, But That Doesn’t Mean It’s Out

- Real Estate Investments: This Is How Timeshares Work

- Yes, Forex Trading Is Legal (And Here’s Why!)

- Should Your Business Accept Cryptocurrencies As Payment?

- There’s No Place Like Home: 4 Tips to Help you Achieve that Home Ownership Dream

- 3 Tricks To Help You Boost The Value Of Your Property Investment

- Precious Metal Investing Tips

- Investing In Gold – For Beginners

- Ways To Invest Your Money Into Your Home Security

- Four Ways To Invest Your Money

- Valuable Gems: What Are the Best Gems for Investing?

- 4 Signs That An Investment Should Be Dropped… Fast

- A Complete Beginner’s Guide to Money and Investing

- How To Win When Investing In Property

- How To Invest In Commercial Property

- Making The Most Of Your Investing Approach

- The World of Finance

- Financial Trader and Entrepreneur, Samuel Leach, Finds Success with First Book

- Increasing Your Wealth In Your Spare Time

- U.S. Money Reserve Soars to New Heights with Iconic Eagle and Animal-Themed Gold Coins

- Managing Your Money When Newly Disabled

- New Angel Investors – Think Of This Criteria Before Starting

- Passive Income Earners To Support Your Self-Employed Business

- 4 Important Facts to Know Before Investing in Coins

- Things To Know When Investing In Property

- How To Make Your Home Investments Pay Off

- What You Need To Know About Conveyancing

- This Land Is My Land… 8 Reasons To Invest In Your Own!

- How Much Money Do You Need to Make a Real Estate Investment?

- Amazing Investment Ideas for the Future

- Why Patience Really Is A Virtue Especially When it Comes To Money

- Understanding How Behavioral Biases Can Impact Your Investing

- What Should A Trader Know Before Getting Started In The Market

- Reviews on stock trading for Oil and other products

- How To Choose The Best Wealth Management Firm

- What is an ETF and How Do You Trade Them

- A Gift from Baby Boomers: Family Investing

- How to Invest in Your Own Future