Investing in startups can be a great way to add alternative assets to your investment portfolio, and make money in the process. If you’ve ever watched programs like Dragon’s Den and wished you could do the same, now you can. It’s your chance to do things like diversify your portfolio, make a huge return on the money you’ve invested with shares in the company, and be a part of the revolutionary life changing technologies that these startups are bringing about. Essentially, you are funding the future.

The great thing about being a startup investor, is that you don’t have to be the founder of a company or do all of the work to get amazing returns. There are best practices to follow when investing in startups, but you must remember that you’ll likely lose a lot of money before you make any. Investing in early stage startups is almost like an art form and it takes practice and skill to master.

Table of Contents

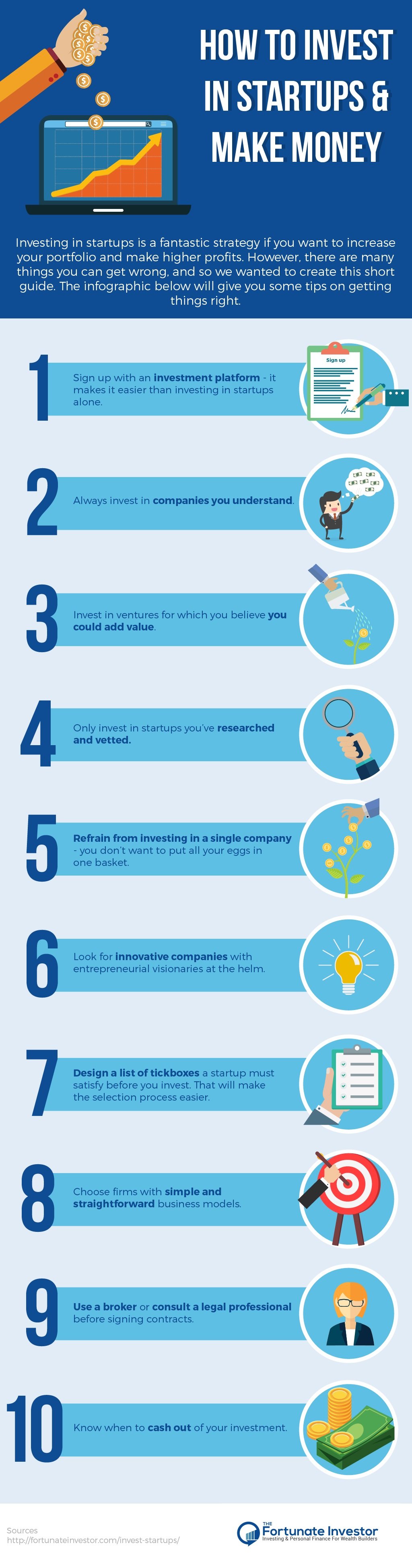

Signing Up With Investment Platforms

Instead of attempting to find startup investment opportunities on your own, it can help to find companies you sign up with. They will help you to find the startups that match your criteria. These opportunities are usually highly curated and vetted so you can make a direct investment without worry. If you’re wondering how to invest in small startups, look into these platforms – they take so much of the hard work and stress out of these types of investments!

Should You Invest In Startups?

Many people have found that these types of investments have worked incredibly well for them, and they’re one of the only ways they can easily generate the results that they crave. Here’s why you should consider looking for start up companies to invest in:

- Diversify your portfolio.

- Generate outsized returns.

- Look smart when you pick the right startups to invest in.

- Generate returns for retirement and later on in life.

- Bring new solutions to life.

- Help to drive positive change in the world.

Of course it’s important to remember that in no way is this a guarantee that you’ll end up with huge returns. The act of investing in startups can be very risky. In fact, you should mentally write off the money you have invested right away. If you can’t do that, then this obviously isn’t an amount of money you can miss, and you should probably rethink your investment.

How To Invest In Startups

That being said, you’ll be pleased to learn that investing in startups, from the kind of law firm funding Silver Dollar Financial offers to startup loans, is probably easier than you think. All you need to do is have some money that you’re willing to invest, do your own due diligence on the startups you’re interested in and follow through on purchasing stock in the companies you choose. You can make your investment in person or with your preferred online platform, after which you’ll receive your stock. It’s probably best to start off with a platform if you’re new to investing!

The question you probably really want to know the answer to is, how to invest in a startup and make big returns on your investment.

How to Invest In Startups and Make Money

You want to generate outsized returns when investing in startups. That much is obvious. Investing in a startup that needs the money can give you a great sense of well being, but this isn’t always enough reason alone to do it. You would love to be one of those success stories that goes viral, and makes millions from a few thousand, right?

Investing in startups is risky, but there are a few ways you can try to ensure you make a return from it. Let’s take a look at a few ways your returns may be realized from investing:

- The company begins paying dividends.

- The company goes IPO.

- Investors sell their shares to other investors.

- The startup is bought by another company.

There’s no real set of rules that you can use when investing to ensure the best result. Many people like to invest in companies that they are interested in and truly believe in, and many also have a criteria that they set out beforehand to figure out whether a company is likely to succeed.

Make sure that whatever you decide to do, you expect some risk. You should never invest more at one time than you can afford to lose. Here are a few key pointers you can take on board if you plan on investing in startups and want to remain safe:

- Invest in something you understand.

- Invest in startups where you may be able to add value.

- Take a portfolio approach to it and invest in a number of deals.

- Only invest in pre-vetted startups.

How you find and invest in startups is a crucial part of succeeding. Make sure you don’t just put in endless research without ever putting money into a startup! Check out consumer startups also.

Some platforms you can join to find startups host exclusive events that you can attend for an annual fee, where you may be able to meet startups directly. You may get many more lucrative opportunities this way! Or, if you’re committed to invest in startups crowdfunding platforms are another great place to look for investments. There’s a lower financial barrier to entry, (although returns will be lower as well), but you can get a feel for what the investment process is like and enjoy the excitement of being part of a community that’s helping to create something new.

Which Startups Should I Invest In?

By now you’re probably wondering which startups you should choose to invest in. There are no hard and fast rules for this, and many investors have their own strategies they like to employ to get the best results.

A lot of the process is about finding what works for you. However, you should make sure you invest in things that you have an interest in and understand, as this will make the process more fun for you. If you’re familiar with the investment world already, you’ll know that much of the advice that’s thrown around today involves ‘intensely diversifying’ portfolios. As it’s safe to say that startups have a fairly volatile nature, you can see why this advice would be given. Definitely diversify your portfolio if you want the best chance of success! That being said, you should never go randomly choosing lots of startups to invest in without doing your research first.

The ‘Spray And Pay’ Method

Some people use this method, called ‘spray and pray’, where you pretty much choose investments at random and hope for the best. However, some believe that this will leave you with a portfolio full of flops, and you’ll end up needing some big wins to make your money back. Even if one big win could help you to make your money back, it isn’t worth investing in lots of startups without checking out the criteria and thinking about it carefully first.

You do need to diversify, but you also need to think about your investments carefully. You shouldn’t invest your money in random startups and simply cross your fingers. Making just one great, thoughtful, early startup decision could give you untold returns on your money. By taking a look at those who invested in the likes of Instagram and Facebook early on, you’ll see what this means!

Choosing Startups That You Believe In

Choose a handful of startups that you really believe in, and put money into them instead. When you put your money into a smaller amount of select firms, you’ll make a more positive impact on the success of that business. Make sure you do your research as well as go with your gut when it comes to selecting the right firms.

Selecting Your Investment Tips

Here are some tips you can use when it comes to selecting startups to invest in:

- Look for founders who are product visionaries. What makes them different from the rest?

- Create a set of filters that tell you whether a startup is for you. For instance, would you like to hang out with the founders? Do they seem as if they’d give back if/when they got big?

- Look for teams who are strong together, addressing huge problems with a tech advantage. A great management team is a great thing to look for!

- Find passionate entrepreneurs to invest in who have specific, non-obvious insights about their industry.

- Do your research on the company so you know how they handle their finances. One metric you can use is ensuring that each company has a recurring annual revenue and a clear earnings predictability.

- Investing in companies with simple business models will allow you to work out how they will make money. Understanding the business is key to success!

Remember, even if your gut is screaming at you to invest in a startup, you should take it slow and consider a few key things first. Here are a few of them:

- Are there lots of small or inactive shareholders?

- Does the company have debts that they may not be able to repay?

- Is there a co founder or shareholder who isn’t active anymore, and needs to be bought out?

- Is there a shareholder’s agreement?

Getting Help And Advice With Your Startup Investments

If you’re confused, then you could potentially get a legal professional to help you. However, chances are you’re going to be hit with a bill for the service. Instead, see if you can approach other angel investors who may have had the same problems before. If they have any level of experience with startup investing, then chances are they can give you some advice.

If possible, surrounding yourself with other investors so you can ask for help will make a massive difference. Spending time with them will give you a good understanding of what you should be doing. Having a good understanding of investing in startups is critical and setup a good plan.

How Startups Update And Communicate With Investors

It’s worth remembering that startups communicate a little differently to one another, depending on their team, budget, and other factors. Some may have the money and means of giving you regular updates, while some may not. Either way, it’s important to be understanding of their situation. It could be worth asking them to send over a sample update before you actually invest your money too.

When you contact your startups, make sure you ask any questions if you have them. You could potentially suggest things they can do to improve depending on how big of an investor you are, and assuming that you’ve chosen a startup in an industry you are knowledgeable about. You must be ready to build up a strong, long term relationship if all goes well.

Investing In Startups: The Conclusion

If you think all of this sounds exciting and fun, then by all means go ahead and do it. You may just find your calling in life! However, startup investing isn’t for everyone, and it certainly isn’t a way you can get rich quick. Startup investing is a long term thing and should be viewed as such. If you want to make money fast, then you should look into other ways of doing so.

Most startups cash flow will be negative for a few years, so you will need to hold tight until you can start making the returns you’re after. That’s why it’s important that you’re mentally comfortable to write your investment off as soon as you’ve made it. Forget about it. It’s gone. Get on with your life. Not comfortable with that? Startup investing is not for you. In that case you might want to start micro investing with small amounts of investments.

Gaining as much knowledge on the topic is crucial, so don’t forget to find people who are doing what you’re doing and see if you can speak to them about it. There are a plethora of articles and books on the ins and outs, and the more specific subjects involved too. It’s in your best interests to educate yourself as much and as often as possible.

Rest assured that startup investing is a skill that you can learn, even if you have no idea what you’re doing right now. Immediately, you won’t be perfect, but in time you will get better at it. Everybody had to start somewhere. Always be looking to learn more and you could go far. The only true way to find out if this is something for you or not, is to go and do it! Join a platform, do some research, and decide where to put your money. Sometimes, the hardest thing to do isn’t learning the ins and outs, it’s just going ahead and doing it.