Table of Contents

What Is Micro Investing?

Micro-investing platforms are a new trend that allows one to save in small amounts away from traditional banks and brokerages. Best of all it allows for very small amounts to be invested (i.e., $1) without any minimums of the traditional companies (usually $3,000). The added benefit is that it removes the transaction fees from each of the traditional minimums (trade fees). Although there is a new trend in brokerages that have NO trading fees at all. What?! Yes, this is becoming normal at large brokerage firms for their ETFs, mutual funds, and now entire brokerage accounts. That said, micro-investing apps allows you to invest in fractional shares instead of the minimum number of whole number shares.

If there is anything to take away from the movie The Big Short, it’s that:

- The stock market is both predictable and unpredictable at the same time

- There is a lot of money you can make by investing

- How does one start investing?

Why do I bring up the Big Short? Because I think that its new, punchy approach to finance may be one of the signs we are seeing young people becoming investors in their own right without any of the traditional baggage associated with investing. Don’t believe me? Consider that while only half of adults 30 and over save more than 5 percent of their income each year, 3 of 5 Millennials are doing so.

Pros of Micro-Investing

- Cost effective diversification

- Don’t need a lot of money to start / Low Minimums

- Low fees

- Automatic Investing

- Start small

- Create good habits

- Automatic investing

How Micro Investing Is Revolutionizing Investing For The 21st Century

Micro-investing is revolutionizing investing for the 21st century by making it more accessible, affordable, and easy for anyone to invest. In the past, investing was often seen as something reserved for the wealthy, with high fees and minimum investment requirements making it difficult for many people to get started.

Investing apps have changed all that, making it possible for anyone with a smartphone and a few dollars to start investing. These apps offer a range of features and benefits that have made investing more accessible than ever before. Here are some of the ways that micro-investing is revolutionizing investing for the 21st century:

Low Minimum Investment Requirements: investing app have low minimum investment requirements, making it possible to start investing with just a few dollars. For example, some apps like Robinhood allow users to buy fractional shares of popular stocks for as little as $1.

This low minimum investment requirement makes it possible for anyone to start investing, regardless of their income or net worth. It also allows users to invest small amounts of money regularly, which can add up over time and help them achieve their investment goals.

Fractional Shares: Fractional shares are another feature of investing app that have revolutionized investing. Fractional shares allow users to buy a portion of a share, rather than the whole thing. This means that even if a share of a popular company like Amazon or Tesla costs thousands of dollars, users can still buy a piece of that share for as little as $1.

Fractional shares make it possible for users to diversify their portfolio with a small amount of money. This diversification can help reduce risk and increase potential returns. It also makes it possible for users to invest in popular stocks and other investments that may have been out of reach in the past.

Robo-Advising

Robo-advising is another feature of investing app that has revolutionized investing. Robo-advising uses algorithms to automatically invest your money based on your investment goals, risk tolerance, and other preferences. This takes the guesswork out of investing and can help users achieve a more diversified portfolio without having to spend hours researching stocks and other investments.

Robo-advisors typically use a combination of ETFs and other low-cost investments to build a diversified portfolio that matches the user’s investment objectives. They may also use tax-loss harvesting strategies to help users minimize taxes and maximize returns.

Automated investing, also known as robo-advising, is another trend in investing app. Robo-advising uses algorithms to automatically invest your money based on your investment goals, risk tolerance, and other preferences. This takes the guesswork out of investing and can help users achieve a more diversified portfolio without having to spend hours researching stocks and other investments.

Robo-advisors typically use a combination of ETFs and other low-cost investments to build a diversified portfolio that matches the user’s investment objectives. They may also use tax-loss harvesting strategies to help users minimize taxes and maximize returns.

One of the benefits of robo-advising is that it can be a low-cost way to invest. Many investing app that offer robo-advising charge low fees or no fees at all, making it affordable for anyone to get started with investing.

Social Investing

Social investing is another trend in investing app that has revolutionized investing. Social investing allows users to connect with other investors, share investment ideas, and learn from each other. Some investing app, like Public.com, allow users to follow other investors and see what stocks they are buying and selling.

This can help users identify new investment opportunities and make more informed decisions about where to invest their money. Social investing can also be a great way to get started with investing for those who are new to the world of finance. By connecting with other investors, users can learn about different investment strategies, market trends, and financial concepts.

Cash Back Rewards

Cash back rewards are another feature that has become popular in investing app. Some apps, like Acorns and Stash, offer cashback rewards for purchases made using linked debit or credit cards. These rewards can then be automatically invested in the user’s portfolio.

Cashback rewards can be a great way to boost investment returns without having to invest any additional money. Over time, these small investments can add up and help users achieve their investment goals.

Educational Resources

Educational resources are also an important feature of many investing app. These resources can help users learn more about investing, financial concepts, and market trends.

More Gen Y-ers are figuring out that it is a good idea to start investing and, just like they do with so many other things, they are not letting themselves be constrained by the traditional options available to them – or even newer trends like making investments in startups. Between new electronic options for investing, penny stocks, and other, smaller investment options collectively known as micro-investing, Millennials are learning how to get into the stock market. And they’re already starting to take advantage of these new avenues to invest their money and reap returns.

So, how is the generation with the largest amount of student debt and difficult future managing to invest so much? The answer involves approaching investment the way you build any good habit – starting small, doing it frequently, and building your way up. That is the essence of micro-investing – replacing large startup capital with an “as you go” approach.

Who Should Use Micro Investing?

Young Adults: Micro investing accounts can be a great option for young adults who are just starting out in their careers and don’t have a lot of money to invest. By starting to invest small amounts of money early on, young adults can take advantage of compound interest and potentially grow their wealth over time.

Students: Students can also benefit from micro investing. With low minimum investment requirements, investing app make it possible for students to start investing with just a few dollars. This can be a great way for students to start building their wealth and learning about investing while they’re still in school.

Low-Income Earners: Micro investing is also a great option for low-income earners who may not have a lot of money to invest. By investing small amounts of money regularly, low-income earners can start building their wealth and potentially achieve their financial goals over time.

Busy Professionals: Micro investing apps can be a great option for busy professionals who don’t have a lot of time to research and manage their investments. With robo-advising and other automated features, investing app can make it easy for busy professionals to invest their money without having to spend a lot of time on it.

Anyone Who Wants to Diversify Their Portfolio: Micro-investing can be a great option for anyone who wants to diversify their portfolio with a small amount of money. Fractional shares and low minimum investment requirements make it possible to invest in a wide range of stocks and other investments, even with a small amount of money.

Socially Conscious Investors: Micro-investing can also be a great option for socially conscious investors who want to invest in companies that align with their values. Many investing app offer a range of socially responsible investment options, such as funds that invest in companies that prioritize sustainability, diversity, or other social and environmental issues.

Overall, micro investing can be a great option for anyone who wants to start investing but doesn’t have a lot of money to get started. With low minimum investment requirements, fractional shares, and other innovative features, micro investing apps have made it easier than ever for anyone to start building their wealth and achieving their financial goals.

How Do investing app Work?

Micro investing apps allow would-be investors with little starting capital to bypass the roadblocks that usually keep them out of the game – minimum investment levels, trading costs, market research, and really just not having a ton of money. Micro investing allows you to build wealth with only a few dollars at a time.

Investing has always had a high buy-in value, which you would think eliminates the generation that is doing everything they can to save whatever they have – but a handful of apps are changing that, and opening the doors for Millennials to try their hand at creating their own investment portfolios.

investing app make it easy for people to invest small amounts of money in various financial products such as stocks, bonds, exchange-traded funds (ETFs), and other investment products. These apps typically use modern technology to simplify the investment process, making it more accessible and affordable to a wider range of people. Here’s a general overview of how investing app work:

Sign Up: To get started with a micro-investing app, you’ll need to sign up and create an account. Most investing app require you to provide basic personal information, such as your name, address, and Social Security number, to comply with Know Your Customer (KYC) regulations.

Funding Your Account: Once you have created an account, you can fund it with money using various methods such as bank transfer or credit/debit cards. Some apps may require a minimum deposit or have transaction fees, so be sure to check the terms and conditions before funding your account.

Choosing Investments: After funding your account, you can start investing in the financial products offered by the app. Most investing app offer a range of investment options, including individual stocks, bonds, ETFs, and other investment products. Some apps offer pre-built portfolios that are designed to meet specific investment goals, such as growth or income.

Fractional Shares: One of the unique features of investing app is that they allow you to purchase fractional shares of stocks and other investments. This means you can buy a portion of a share of a company’s stock, rather than having to buy a full share. This makes it possible to invest in expensive stocks that may be out of reach for small investors.

Automatic Investing: Many investing app offer automatic investing features that make it easy to invest regularly without having to think about it. You can set up recurring investments on a weekly, bi-weekly, or monthly basis, and the app will automatically invest the specified amount of money in your chosen investments.

Fees: investing app typically charge fees, such as account maintenance fees, transaction fees, and management fees. Be sure to read the app’s fee schedule carefully before opening an account to understand how much you’ll be charged for using the app.

Monitoring Your Investments: Once you have invested in a financial product, you can monitor your investments using the app. Most investing app offer a dashboard where you can see your investment performance, track your investment goals, and make adjustments to your investment portfolio as needed.

In summary, investing app make it easy and affordable to invest small amounts of money in various financial products. By offering fractional shares, pre-built portfolios, and automatic investing features, these apps have made it possible for anyone to start investing in the stock market, even with just a few dollars. However, it’s important to keep in mind that these apps do charge fees, so be sure to read the fee schedule carefully before opening an account.

What are the Latest Trends in Micro Investing?

Investing app have revolutionized the way people invest their money, allowing anyone with a smartphone to easily and affordably invest in stocks, ETFs, and other financial instruments. These apps have opened up the world of investing to a wider audience, breaking down barriers to entry that previously made it difficult for many people to invest.

In recent years, investing app have become increasingly popular, with millions of users signing up to platforms like Robinhood, Acorns, Stash, and SoFi. These apps offer a range of features and benefits, designed to make investing accessible and easy for anyone.

One of the latest trends in investing app is the ability to invest in fractional shares. Fractional shares allow investors to buy a portion of a share, rather than the whole thing. This means that even if a share of a popular company like Amazon or Google costs thousands of dollars, investors can still buy a piece of that share for as little as $1 or $5.

Fractional shares have become a popular feature in many investing app, as they allow investors to diversify their portfolio with a small amount of money. For example, if an investor has only $50 to invest, they can buy fractional shares in five different companies, rather than just one. This diversification can help reduce risk and increase potential returns.

Another trend in investing app is social investing. Social investing allows users to connect with other investors, share investment ideas, and learn from each other. Some investing app, like Public.com, allow users to follow other investors and see what stocks they are buying and selling. This can help users identify new investment opportunities and make more informed decisions about where to invest their money.

Social investing can also be a great way to get started with investing for those who are new to the world of finance. By connecting with other investors, users can learn about different investment strategies, market trends, and financial concepts. They can also get feedback on their own investment ideas and learn from the successes and failures of others.

Cash back rewards are another feature that has become popular in investing app. Some apps, like Acorns and Stash, offer cashback rewards for purchases made using linked debit or credit cards. These rewards can then be automatically invested in the user’s portfolio.

Cashback rewards can be a great way to boost investment returns without having to invest any additional money. For example, if a user earns $5 in cashback rewards for a purchase, they can automatically invest that $5 in their portfolio. Over time, these small investments can add up and help users achieve their investment goals.

Educational resources are also an important feature of many investing app. These resources can help users learn more about investing, financial concepts, and market trends. They may include articles, videos, podcasts, and interactive tools designed to help users make informed investment decisions

Start Investing!

Take that extra coffee money and put it to use! Start by rounding up on your purchases. If it costs $5.50 just save the extra $.50 cents and put it into your savings. Once you have a few dollars saved you can let your money work for you. Start investing by micro-investing to get yourself started.

Yes, you heard it right, there’s an app for that.

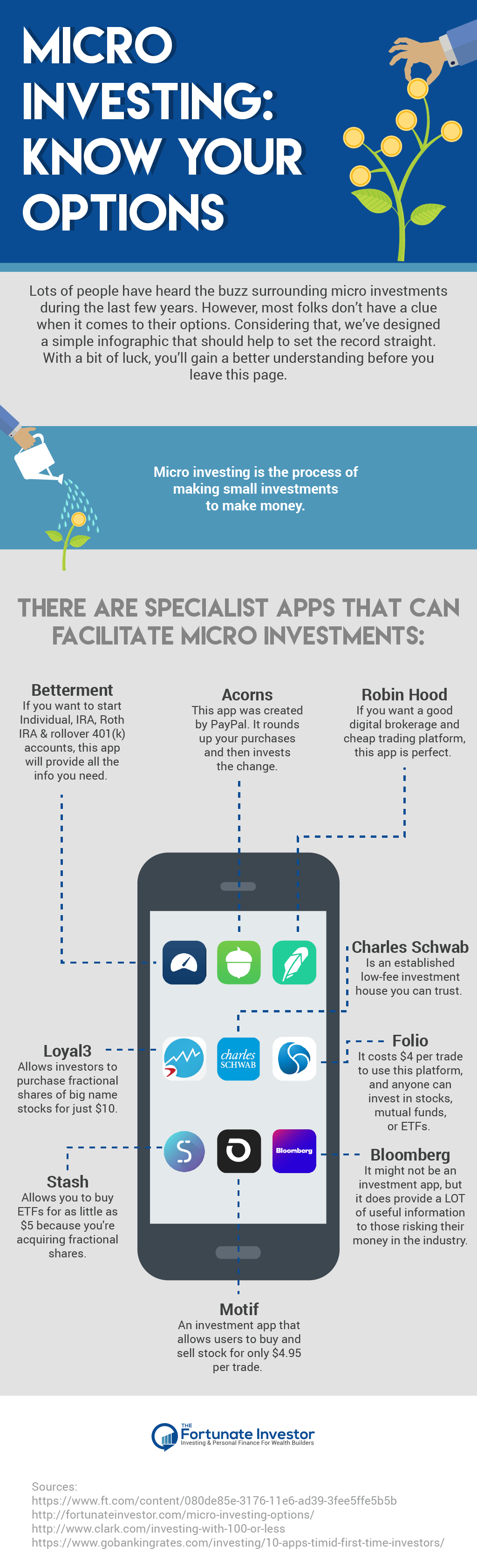

Here are a few of the best investing app to take you from rags to riches, one penny at a time:

Betterment

Betterment is the most established business. They have no initial cost and a very good 0.35% annual fee for account balances below $10,000. Betterment focuses more on financial advice that stretches far beyond the stock market.

So, is betterment a good investment? That depends on what you looking for. If you’re looking to start an Individual, IRA, Roth IRA & rollover 401(k) accounts, Betterment will have personal advice just for you. Betterment also offers auto-investing options, and will automatically re-balance your portfolio for you.

For those that would like a personalized experience from starting their retirement fund to building their portfolio, to learning about tax-loss harvesting and trusts, Betterment is a good choice.

Was it mentioned that they are already managing over $5 Billion for over 100,000 customers?

No minimum investment makes this a possibility for all financial situations.

Acorns

When Paypal invests $30 million in an app, something good may be happening.

Acorn financial services work much like some of the newer savings accounts banks offer works. It rounds up your purchases to the nearest dollar and then invests that change into one of many portfolios ranked by risk – the more aggressive, the more upside.

The Acorn finance strategy is like taking the proverbial change jar and putting it into stocks.

While investing your spare change is the whole idea, there is an option for automated monthly deposits, which you’ll probably want to set up eventually if you are planning to retire comfortably.

Your Acorns account needs a minimum of $5 to start investing, so for the price of a cheap lunch, you could start a no-hassle investment portfolio.

Robin Hood

For the DIY financier who doesn’t need advice but rather a cheap trading platform. You may consider Robin Hood. With no initial cost or fees, it may be an option for certain people. While, it might sound too good to be true, but the premise is simple. Robin Hood is able to do this by making money off interest if the money is in accounts (customers are not charged), moving orders through certain platforms, as well as when clients borrow to trade. Robin Hood is now one of the largest online brokerages in the United States and is now worth over $5.6B.

Being a digital broker eliminates much of the operating costs of traditional brokerage faces.

Add to that the fact that electronic trading firms pay nothing to trade on Wall Street, and you have Robin Hood, bringing these advantages to the layman trader looking to strike it rich on their own accord.

An interesting option for those ready to dive into the world of trading.

Loyal3

Loyal3 lets you buy fractional shares of big-name stocks for just $10. Account set-up is free, and there are no fees to buy or sell a stock.

Unfortunately, about 60 big-name companies are available. Some of the big-name companies include Google, Netflix, Coca-Cola, and Starbucks.

As a pro, access to trading is normally is not expensive. The con is that Loyal3 does not have access to index funds or ETFs.

This app is great for someone learning the ins and outs of the market through experience but doesn’t have thousands on hand to do the trading. With companies offering IPOs (buying a stock before it goes public) it may be worth checking out.

Charles Schwab

“Wait a minute, this isn’t a new app for Millennials!” If this was the first thought that crossed your mind, then you are correct. However, Chuck gets a mention here because they might be the leading low-cost investment house that you’ve already heard of.

Schwab can get you started for as little as $10. Plus, they compete with some of the aforementioned apps with fees, which is worth the mention.

Their index funds are very appealing to beginning investors, including ones that track the S&P 500 and Dow Jones indexes.

Schwab also has a checking account with no ATM fees, which is worth passing on to your kids looking to open accounts. Maybe they could invest those saved fees into a portfolio instead

Honorable Mention

A few noteworthy of our honorable mention list include Stash, Wealthfront, Wisebanyan and Clink.

Additional Consideration:

MoneyLion

Improve your financial health with the free MoneyLion App. Get a better way to borrow, save, and invest with Moneylion Plus.

Rize

Rize takes a different approach and is a standalone app to “save and invest for what matters”.

Easiest to Use Apps

There are several investing app available in the market, each with its unique features and advantages. Here are some of the easiest to use investing app that can help you get started with investing:

Editor Picks:

Robinhood: Robinhood is a popular micro-investing app that offers commission-free trading for stocks, ETFs, options, and cryptocurrencies. The app is straightforward to use, and the interface is user-friendly, making it easy for beginners to navigate. Robinhood also offers fractional shares, allowing investors to buy and sell small portions of shares.

Acorns: Acorns is a micro-investing app that rounds up your daily purchases to the nearest dollar and invests the spare change in a portfolio of ETFs. The app also offers recurring investments, one-time investments, and other investment features. Acorns is an excellent option for investors who want a hands-off approach to investing, as the app automatically invests your money based on your preferences.

Stash: Stash is a micro-investing app that allows investors to invest in fractional shares of stocks and ETFs. The app offers pre-built portfolios based on investment themes, such as clean energy, technology, and healthcare. Stash also offers educational content and investment advice to help users make informed investment decisions.

M1 Finance: M1 Finance is a micro-investing app that offers fractional shares and pre-built portfolios. The app allows investors to create custom portfolios and offers automated investing features. M1 Finance also allows users to borrow against their investment portfolio through a low-cost line of credit.

Betterment: Betterment is a micro-investing app that offers automated investing features and personalized investment advice. The app offers a range of portfolios based on investment goals and risk tolerance, and it automatically rebalances your portfolio to keep it aligned with your goals. Betterment also offers tax-loss harvesting and other tax-efficient investment strategies.

Wealthfront: Wealthfront is a micro-investing app that offers automated investing and financial planning features. The app offers a range of portfolios based on investment goals and risk tolerance, and it automatically rebalances your portfolio to keep it aligned with your goals. Wealthfront also offers tax-loss harvesting, direct indexing, and other tax-efficient investment strategies.

These are just a few examples of the easiest to use investing app available in the market. Each app has its unique features and advantages, so it’s important to research and compare different apps before choosing the one that best fits your investment goals and preferences.

Start Using Micro Investing Apps!

The takeaway from these apps is that they are not only helping young adults think about retirement earlier. But, they are also helping them think outside the box when it comes to saving money in general. Remember these important things before you start investing.

You only need a small amount of money to start using investing app.

It’s not just about stashing that cash under the mattress for a rainy day. It’s about planting a “money tree” that will provide for you for years to come. The good news is the seeds are all available in your cell phone’s app store.

Who would have thought Millennials would be revolutionizing an arena that’s always been dominated by the older generation? It goes to show you that small steps and creative thinking can make an investor out of anyone.

Micro-Invest!

Micro investing is a great way to start investing but know that micro-investing also won’t create significant wealth. Keep saving and putting your money to work. The earlier you start the better so get started now! The apps are available for both Android and iOS which makes it easier than ever to get started and manage.