Working for a living is a very common concept. It’s something the majority of adults do, in order to pay the bills; however, there’s a lot of debate surrounding how long the hours are and if people are being paid correctly in response to this. This debate has been raging since the idea of working for a living was first founded, and in the modern day and age, it’s become more vocal than ever.

Working for a living is a very common concept. It’s something the majority of adults do, in order to pay the bills; however, there’s a lot of debate surrounding how long the hours are and if people are being paid correctly in response to this. This debate has been raging since the idea of working for a living was first founded, and in the modern day and age, it’s become more vocal than ever.

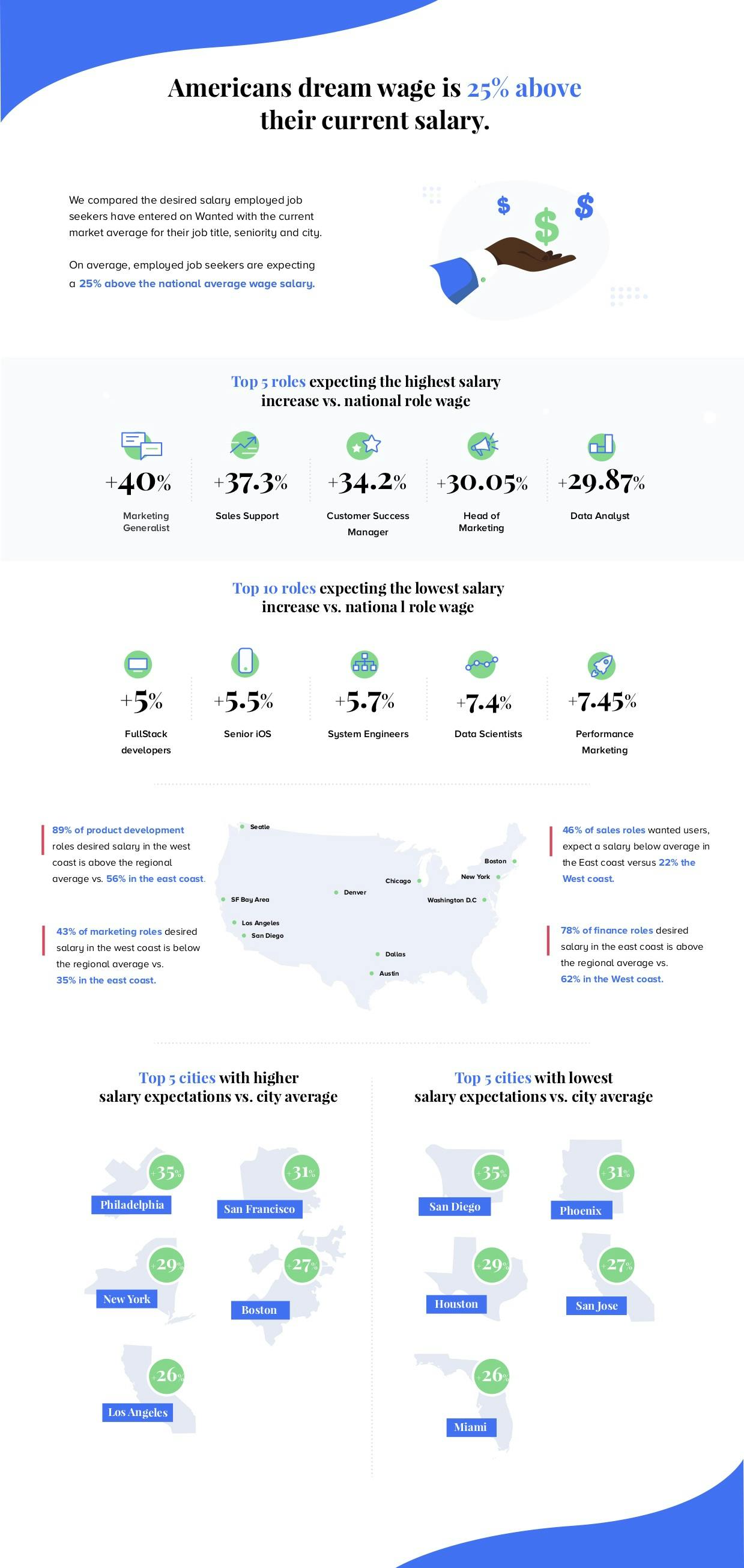

We’ve been able to share more and more about our wages as a collective society in recent times. Both in and out of the workplace, people are often ruminating about how their wages compare to their colleagues in multiple fields. Many people have dream wages; numbers in their head they’ve love to be paid, or they’ve done a little research into the average numbers in their field and believe they deserve a bit more. Indeed, in order to determine your dream wage, you would need to have an expectation about what you’re owed for working 9 hour a day, 7 days a week.

Before even applying for a job, the salary available should be listed in the job description, and should be an indicator about whether the job is right. If you want to know more about what the average American thinks about their current income, in the form of the wage they receive from their job every month, here’s an infographic that goes into a lot more detail below; feel free to check it out.