When you’re just starting off as an investor, it pays to be wise and to look for steady, long-term gains while you are building your knowledge-base and exploring ways to earn greater returns at minimum risk. Here are 5 ideas to consider, plus a bonus idea to protect your financial stability over the long-term.

When you’re just starting off as an investor, it pays to be wise and to look for steady, long-term gains while you are building your knowledge-base and exploring ways to earn greater returns at minimum risk. Here are 5 ideas to consider, plus a bonus idea to protect your financial stability over the long-term.

1. Saving accounts

Fixed-term accounts are great option for risk free-savings. They’ll typically generate a higher rate of return than most savings accounts. The disadvantage (depending on your point of view, of course) is that these do require a longer-term commitment than instant-access accounts. To get maximum benefit from the investment, and avoid penalties, you’ll have to be sure that you won’t need to access the funds until the agreed term is complete. They’re available from most banks, so are easy to set up, and the term can be as short as 3 months.

2. Mutual Funds

Although traditionally a sizeable lump sum of cash would be needed to gain access to a mutual fund, these days there are many which only require a deposit of $100 or even less to get started. The benefit of these funds is that, rather than placing the entire investment into one stock, you are taking a share in a portfolio which can be spread over hundreds of different stocks. Mutual funds are managed by experienced investors who minimize the risk and focus on long-term performance. They’re considered a great choice for anyone just getting started, and are recommended for long-term investments.

3. Property

Properties are one of the most obvious assets that make money for you. However, if the reality is that you are still some way off being able to purchase your own property, there are other ways to get started in real estate investing. For example, there are several crowdsourcing platforms which enable you to take part in real estate transactions, either by lending money or purchasing a share of some real estate. CrowdStreet, and EquityMultiple are just two of the platforms to explore.

4. Your Skills

You may not immediately think of it, but one of your most important assets is your expertise in any given area. If you’re employed by day, there’s no need to give up the security of a regular paycheck.

However, in these days of economic uncertainty, more and more employers are looking for freelancers to take on work. Sites such as Guru and Upwork allow you to offer your skills as often as you like, for projects that interest you, at the rate you want to earn. Yes, there’s some effort involved, but if you really want to make the most of your skills, freelancing can provide a valuable additional income stream. No investment is needed to get started, and but expect to pay a commission on your earnings, so take that into account when you’re bidding for projects.

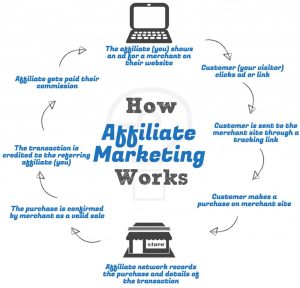

5. Affiliate Marketing

Affiliate marketing is one of the easiest ways to generate a passive income online. The only outlay is your marketing – your website or blog, plus other promotions you choose. You don’t set your prices, but take a commission. There’s no customer support involved, as the buyer deals directly with the supplier.

Bonus: Insurance

Not technically an investment, but, an important way to mitigate the risks that could derail your plans for financial growth. You shouldn’t neglect it. Accident, sickness and unemployment insurance policies are relatively inexpensive and can all be considered as solid investments to avoid the risk of an unplanned loss of income, whether temporary or permanent.