When you are a parent, finding ways to save money where you can, is important. The cost of feeding your child is no exception. Here are some options to help you cut costs without compromising on quality when feeding your baby.

-

Table of Contents

Breastfeed

If you are able to breastfeed your child for at least 6 months to a year or more, this can translate into big savings. There are other advantages to breastfeeding as well. Breast milk contains antibodies that helps the baby fight off viruses and bacteria. It lowers the child’s risk of asthma and allergies and allows for the baby to experience fewer ear infections, respiratory illnesses and diarrhea.

The monthly cost of formula for households per child is $100-$120 Canadian dollars.

Total annual savings from breastfeeding = $1,200 = $1,440

-

Research coupon sites

If you’ve read some of our other articles about couponing, you know how valuable they can be. Do some research before paying full retail price on baby formula. Most major retailers and manufacturers offer coupons on products year-round through their website. Most websites give you the ability to filter through hundreds or thousands of coupons and only view baby related products. Be sure that the coupon will be accepted in your country and local area. For example, some coupons may be acceptable in the United States and not in Canada and vice versa, even it is from the same manufacturer. Depending on the brand, size, and country where the coupon is found, you can save anywhere from $2-$8 per coupon of infant formula.

Total savings = $2-$8/coupon of baby formula

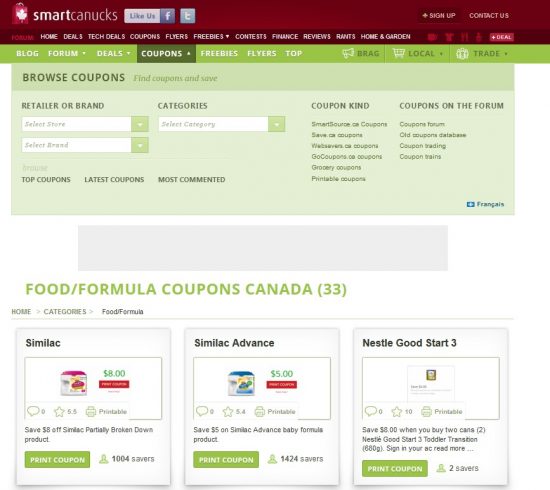

SmarkCanucks.ca is an example of a website that offers thousands of coupons specifically for Canadians. In the example below 33 matches were found for baby formula alone.

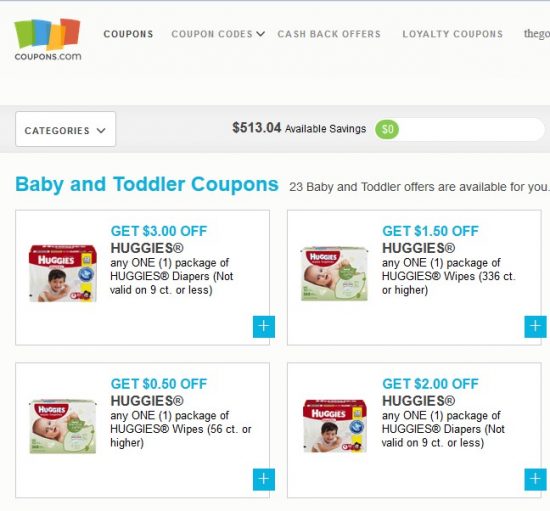

Coupons.com is another example of a credible site. Although you cannot search for formula specifically. The site lets you filter by baby products. We found baby formula coupons for a third of the 23 infant products searched. It’s amazing how much money you can save as a couponer.

-

Sign Up for Manufacturer’s Baby Programs online

Many major manufactures of baby formula like Nestle, Enfamil and Similac have baby programs on their websites that offer support and market to soon to be and new parents. These programs offer parents nutritional advice, printed and digital magazines on a child’s development, videos, support and community chats among other things.

To entice users to sign up for the program, they will typically offer a combination of free samples and coupons to be sent by mail in exchange for signing up for the program and allowing them to market products to you. Below are three sites that offer baby programs and the value in free gifts they provide.

Nestle Baby Saving Program

Total average savings on baby formula for signing up may vary. Value of gifts include other baby products like pacifier, diapers etc.

-

Request formula as a baby shower gift

Another great way to save on formula is not to buy it yourself, but have friends and family buy it for you. If you know you will be breastfeeding your infant, consider requesting baby formula or store gift cards to places that sell baby products like groceries stores, Walmart and other low cost retailers. Requesting baby formula as a gift is most ideal when:

- Your particular about the purchase of other baby products like clothing items and want to purchase these items yourself.

- You are on your second child and will use the infant items you currently have from your first child (like clothes, toys, baby equipment) for your baby

- You have siblings that already had their babies and are willing to donate their infant clothes and toys to you.

Total savings may vary depending on each family’s unique situation.

-

Food bank or pregnancy clinic

The food bank and pregnancy clinics are great places for struggling families to get their immediate needs met. Individuals, churches and other organizations donate food items, clothes and money to food banks and non profit organizations. I am not advising to use a food bank to save money if you can afford to pay for it yourself, but if you are genuinely struggling financially, there are non-profit organizations that offer services and resources for low income families that need it.

If you live in Canada and you are not sure where to find one in your province, simply call 2-1-1. This is the Community and Social Services Help Line. Each province provides different health and social services. They will direct you to the nearest food bank or pregnancy clinic in your area. This Help Line can also provide you with information on other social service needs like: women’s shelters, free tax clinics, subsidized child care and housing and much more.

If you live in the United States, you can contact your local Women, Infant and Children (WIC) clinic. Through federal grants offered to states, WIC offers supplemental foods, food packages, health care referrals and nutrition education for low-income pregnant, breastfeeding, and non-breastfeeding postpartum women, and to infants and children up to age five who are found to be at nutritional risk. A list of toll free numbers to contact a WIC clinic in your area can be found here.

Total savings may vary depending on state funding and financial situation of each family.

-

Hospital, family doctor or pediatrician

Ask your health care provider for additional infant formula samples. Many doctors get lots of samples from manufacturers to give to patients to promote their products. Depending on the supply and demand at your facility, some doctors may not mind giving away additional samples to parents that would like it.

Total savings vary.

The cost of raising children can get expensive. Finding creative ways to save money on baby items can go a long way and the cost of baby formula is no exception. Use these tips and others to reduce the cost of infant formula. The small savings done consistency over time will go a long way.