Table of Contents

As a parent, teaching children about money is a tricky subject

We want to give our kids everything – but we also want to teach them the value of a dollar. Sometimes that means saying no to your kids, and sometimes that means encouraging them to take responsibility for their own financial security.

The more you can teach your kids about managing money during their early and teen years, the better off they’ll be.

Help prepare them for successful adulthood by fostering a basic understanding of budgeting, planning, earning, and saving money. To help you get started, we’ve created free printable chore charts for kids and some extra goodies (like an extra chore list for kids) designed to be engaging and fun.

Budgeting Money With Kids

Family Budgeting is a crucial skill that even adults can struggle with. How do you create a realistic monthly budget? What are the consequences of overspending? When is it okay to ‘splurge’? While these are concepts that younger children don’t need to grasp, your teenage children likely will, so it’s helpful to keep them in mind as you’re starting to teach them essential money management.

A simple way to introduce this concept is to provide children with money – either real currency or play money – to help them visualize the concept and the physical reality. (This is also a great way to support school-aged kids learning basic math skills like addition and subtraction.) Once they’ve made that connection, then you can introduce planning.

Planning

Teaching your child the skill of planning their spending will not only impact their ability to manage money but also supports the development of patience and a basic understanding of value. Using a family chore chart can help keep everyone on track, so there’s never any question of who is responsible for which household tasks.

For example, if there’s a new toy they’d like to have, help them to make a plan for buying it. For example, if their weekly allowance is $5, and a toy they’d like to have is $20, make a chart they can check off to let them know how far along they are to reaching their goal. This can also be an excellent opportunity to explain why buying another item could make the wait for what they want even longer.

Earning: The Value of Using Chore Charts for Kids

Giving your child a few daily responsibilities, and using weekly chore charts to track their completion, helps them to get an early introduction to the concept of earning money. This helps prepare them for successful adulthood by fostering a basic understanding of budgeting, planning, earning, and saving money. Being responsible for simple household chores will also support them as they transition into preschool and kindergarten. Students are expected to clean up their play areas of toys and follow the teacher’s instructions.

To start using chore charts with your child, choose 1-2 simple items – like making their bed, brushing their teeth, putting dirty clothes in the hamper, or picking up their room. (We’ve included a free printable chore list for kids below.) Initially, you’ll help them complete these tasks every day, and once finished, help them to put a sticker on their chore charts. You can slowly add new items to the chore charts as they grow and learn to complete these tasks independently.

Review the completed chore charts with your children at the end of each week before giving them their weekly allowance. If, for some reason, the chore chart hasn’t been completed, consider reducing that week’s allowance and having a clear discussion with your child as to why their allowance is smaller that week. Over time, using a chore chart is a valuable, easy tool to teach responsibility and even time management.

Saving Money Tips for Kids

Even young children should be encouraged to save at least a part of their allowance in a piggy bank or a clear glass jar.

For school-age children, help them to find a charity they are interested in supporting, and even offer to match their donation when they’ve reached a financial goal. Writing out the donation check and delivering it to the charity is a valuable lesson in generosity, caring, and community.

Fortunate Investor Printable Chore Charts for Kids (& More!)

We’ve created a comprehensive set of printable tools to help you teach your children these concepts, putting them well on their way toward a healthy financial future. Here’s how to use each printable to start teaching children about money. Download the How To Guide: Fortunate Investor How To Teach You Kids About Money Guide

Play Money – An Easy Reward for Chores

Download the Play Money: Fortunate Investor Play Money. This is money you can print – so you don’t always have to have cash on hand to pay out allowances.

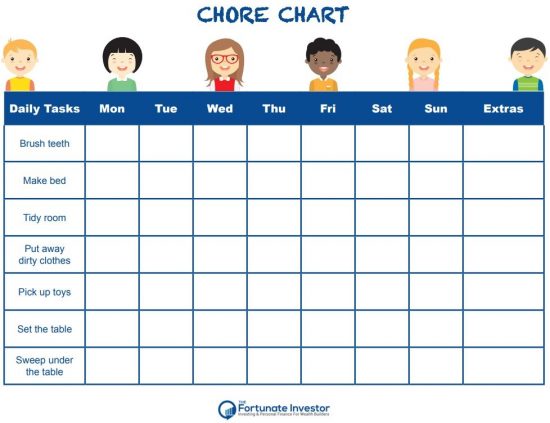

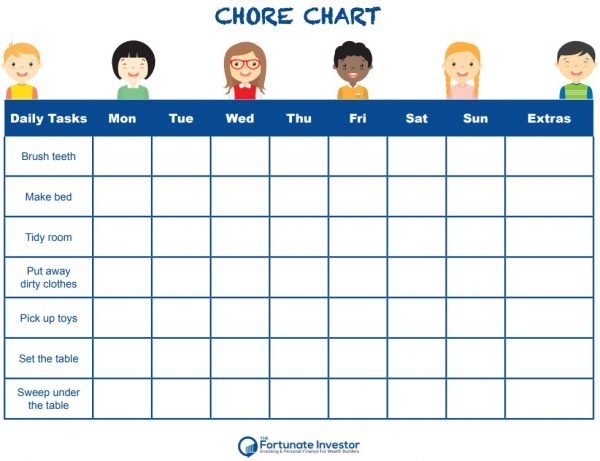

Kids Chore Charts

Download the free Chore Chart: Fortunate Investor Chore Chart

Each week, print out a new Chore Chart for your child. Let the child put stickers on their chore chart as they complete each chore. Have your child choose an ‘Extra Chore’ stick to complete each day and write the task into the empty box.

Review the completed chore chart with your child at the end of each week before giving them their allowance.

Age-Appropriate Chores Tips

You’ll need to supervise their chores with more minor children until they’re comfortable with the routine. For older children, discuss with your child how much the ‘Extra Chore’ will be worth before they get started.

Extra Chore List for Kids – Cooperative & Independent Tasks

Print out and attach the extra chores to wooden sticks, and put the sticks into a jar or basket. Each day, your child can pick an ‘extra chore’ to complete in addition to their daily chore chart tasks. You can decide how much monetary value you put on the extra chores, depending on how big of a task it is. Download the Extra Chores: Fortunate Investor Extra Chores

For chore sticks with a ‘blank’ on them, you or your child can choose which room to complete the chore for.

Find a chore: Let your child find something around the house that needs doing, and ask them what they think the completed chore is worth. (You may need to do some bargaining!)

Find a chore bonus: Ask your children to work together to find and complete a chore around the house.

We hope you enjoy using these free tools to start teaching children about money in a fun, engaging way

Developing healthy financial habits at a young age will set them up for more excellent financial stability as they grow to adulthood, and no price can be put on that. Remember, it’s a process, so don’t get discouraged if your child initially struggles with these concepts. Be consistent and encouraging, and have fun using these printables to introduce these valuable concepts – and set your child off on the road to financial freedom.

Additional Money Management for Kids Resources

Do you have a family chore chart system? Share your success stories on our Facebook page.

Extra Money Tips For Younger Kids

Make money fun. Here’s a recent guest article we created on 10 Easy Ways to Teach Kids About Money.

As a clinical therapist, I know parents try to teach their kids everything. From academics to safety, manners, how to drive, excelling at sports, the list goes on; it’s no wonder many parents forget to prepare their kids and teen to be financially responsible. Many young adults leave their parent’s homes and have no idea how to manage minimal finances. They do not even know the importance of paying down credit card bills. As a money-savvy parent, you know better, and you need to teach your child to be financially savvy at a younger age.

When To Teach Your Kids

The average child should be ready to learn about essential finances at around age ten. Of course, some kids are ready earlier and others later. The best way to teach a child about money is an allowance system. This way, your kid is not just being lectured about spending and saving. They are practicing and experimenting with saving, spending, and budgeting. And using visual tools, like play money and a kid-friendly chore chart, can make this a fun, engaging activity rather than a painful slog.

Setting Up An Allowance

There is no “one size fits all” program. Consider these factors to make the best plan for your kid.

- The age of your child

- Should they earn money with jobs and chores or be given the money

- How much should he or she be responsible for

- How often do you give the allowance, weekly or monthly

Why Is A System Important

If you have a younger child, you will want to keep things simple by only requiring the child to pay for the “extras.” Things like toys (outside of birthday and holiday gifts), spending money at the mall, or seeing a movie with friends. Anything that you do not consider to be necessities. If your child makes a budgeting mistake, you still cover all their essential needs.

You can approach a teenager differently. They should be more capable of managing money, have some experience with budgets, and understand how far a dollar goes. You may ask your teenager to be responsible for the “extras” and clothing, gas, and meals out with friends. Teens are closer to living independently and paying for necessities, so it’s best to teach these lessons while they’re still under your roof.

How Much Money To Give

Once you decide what your child/teen will be paying for independently, you need to decide how much money to give. The most important advice is to set your child up for success! Think hard about the amount of money to give. With too little money, your kid will soon feel frustrated and angry about the system you have implemented. Too much money and you’re child will completely miss the purpose. They will be able to buy anything and everything and not need to make difficult but necessary spending choices.

Once you decide what your child/teen will be paying for independently, you need to decide how much money to give. The most important advice is to set your child up for success! Think hard about the amount of money to give. With too little money, your kid will soon feel frustrated and angry about the system you have implemented. Too much money and you’re child will completely miss the purpose. They will be able to buy anything and everything and not need to make difficult but necessary spending choices.

Ideally, you want them to save for more significant items. Imagine your kid putting aside a portion of their allowance each week to save up over months for the latest Xbox system. You, and most importantly, they will gain a tremendous sense of accomplishment and pride when finally going to buy that toy. This feeling does not compare if you buy the item for him on any random day or even if they open it as a holiday gift.

Stick With Your Plan

Prepare yourself not to give your kid more money if they run out. The child or teen will make mistakes. It is through learning the hard way that they make better spending choices. If your kid runs out of money and you give them more before it’s time, you’re not teaching anything. Instead, if your child runs out of money early, sit down together and look at where the money was spent and why it ran out. Show them some other ways to handle the money differently next time.

Financial challenges are one of the top stresses in most adults’ lives. Yet, too many parents do not prioritize teaching their kids about finances. They may be too focused on the child’s academics or less practical hobbies or interests. Parents can easily get started teaching by setting up an allowance system for their child or teen to start making independent financial decisions at an earlier age.

I also recommend parents read Money Doesn’t Grow On Trees to prepare their kids to be financially responsible adults.

Let’s face it; money is a touchy subject. Parents handle this topic with their children in a wide variety of ways. Some parents believe the more you discuss money with children, the better prepared for adulthood they will be. Other parents make a point not to talk about money around their kids.

Let’s face it; money is a touchy subject. Parents handle this topic with their children in a wide variety of ways. Some parents believe the more you discuss money with children, the better prepared for adulthood they will be. Other parents make a point not to talk about money around their kids.

Parents Who Don’t Discuss Money Enough

A surprising number of parents worry about exposing their children to financial stressors, so they never discuss the topic with their children. This can send the message that there is something problematic or taboo about the subject of money. These children who are less educated about money may not be able to appreciate what they have or not develop a sense of work ethic as they get older. As these kids become teens and young adults, they may not have the education needed to become financially responsible adults. I recommend parents looking to teach kids about money read Money Doesn’t Grow On Trees.

Parents Who Discuss Money Too Much

Conversely, parents can be too open about money with their children. These parents can unknowingly cause their children to be anxious about money. The child can feel like a burden to their parent when he or needs or wants anything. No parent would want this even if the family is struggling financially.

There is not a perfect way to talk to children about money. But here is a quick guide of DO’s and DON’Ts when trying to find a balance for your family.

What To Do

1. Do talk about money in a casual, general manner. It is a significant component of adult life. There is no need to shield all financial discussions from your child.

2. Do teach kids how much certain items cost.

3. Do encourage a teenager (when appropriate) to get a part-time job to learn adult responsibility and contribute a portion to the family (when needed).

4. Do take your child/teen to the bank to open a checking account and learn about saving and withdrawing money.

5. Give your child money when needed and discuss expectations for how the money should be spent and budgeted. Then follow up about how the money was spent.

What Not To Do

1. Do not go into detail about financial struggles that will let your child (especially younger children) learn about uncertainty and instability in their life. There is nothing your child can do to improve their financial situation, so there is no reason to put this burden on her.

1. Do not go into detail about financial struggles that will let your child (especially younger children) learn about uncertainty and instability in their life. There is nothing your child can do to improve their financial situation, so there is no reason to put this burden on her.

2. Do not knowingly make your child feel bad about his fortune and what you have been able to provide.

3. DO NOT put a “guilt trip” on your child when you choose to buy her something.

4. Do not give your child everything she wants and when she wants it. Suggest putting the item on a “wish list” for a birthday or holiday gift. She will more likely value the item when waiting is necessary. Or if the child is older, show him how much something costs and put money aside until enough funds are saved for the purchase.

5. Do not give your child/teen your credit card, which they can spend unlimited amounts of money on with no responsibility for paying the balance. This only encourages thoughtless spending, not responsibility.

If you’re a parent, the last thing you want for your kids is for them to have to worry about money. On the other hand, overprotecting them from financial realities during childhood can mean they grow up to be adults with those very worries you hoped to protect them from. Teaching children about money gives them valuable life skills; you can make it a regular part of your family’s life.

Young Children

When your kids are as young as 3, you can begin introducing them to money. Young children may struggle with abstract concepts, so sticking with coins and bills at this stage is best. This is also the age when they are first learning to count, which makes learning about the value of various coins and a dollar a perfect match. They can start doing chores around the house to earn an allowance and save it up for small toys or other items they may want. At this age, a clear glass jar may work better than a piggy bank since it gives children a better visual sense of what they are saving. Kids can begin learning the concept of giving at this age as well, donating a small portion of the allowance they receive to something important to them. You can also talk to them when you go shopping about what things cost.

Tweens

Children between the ages of 8 and 12 can handle more sophisticated financial concepts. At this age, you can take them to open a bank account. A savings account can introduce them to the concept of interest and how their deposits can grow in value simply by leaving them in the bank. At the grocery store, talk to your kids about comparison shopping. Tweens are also old enough to start participating in some family financial decisions. You can work together on a family budget. Conversations might include what streaming services to subscribe to or where to go on vacation.

Teenagers

With younger teens, you can start to have increasingly sophisticated conversations about financial concepts. Older teens can get a part-time job and start looking at the costs of such things as a car and a college education. This is an excellent time to find out the costs of colleges your child is interested in and discuss how to paying for school will be worked out. You might use a combination of savings, money earned by your child, grants, scholarships, and student loans. Talk to your teen about taking out student loans and what a reasonable amount to borrow is based on the career they are planning to enter. This is also an excellent time to start discussing how to handle credit cards since they will begin to get offers when they turn 18. You may be able to get your child a card before this age that will help them begin to understand the responsibility of having one before leaving home.